Orbit Chain Lost $86 Million in cryptocurrency, specifically Ether, Dai, Tether, and USD Coin.

Orbit Chain is a blockchain platform that serves as a versatile hub for multiple assets, supporting interoperability among different blockchains, decentralized applications (DApps), and services.

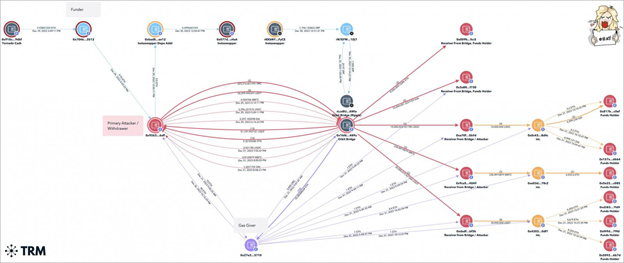

On December 31, 2023, a Cyber-Attack on Orbit Chain started with an unauthorized transaction, marking the beginning of a series of drain attacks. These Cross-Chain Bridge Exploit attacks were carried out by unidentified hackers and targeted multiple asset types.

Orbit Chain Lost $86 Million and Balance Plummeted from $115 to $29 Million

According to Arkham, a blockchain intelligence platform, Orbit Chain’s balance plummeted from $115 million to $29 million in an instant. This suggests that the estimated losses from Orbit Chain Cyber Attack amount to approximately $86 million.

While Coindesk posted regarding this incident stating that “Orbit Chain Loses $81M in Cross-Chain Bridge Exploit”, however, BleepingComputer has reported that Orbit Chain Lost $86 Million in the cyber incident.

The specific method employed by the hackers to execute the Orbit Chain Hack remains undisclosed at present.

While the identity and location of the attackers have not yet been confirmed, they exhibit characteristics typically associated with highly skilled state-sponsored hackers, suspected to be affiliated with North Korea.

Source: (TRM Labs)

Cyber-Attack on Orbit Chain Suspected to be Linked with North Korea’s (DPRK)

Orbit Chain has taken immediate action by collaborating with the Korean National Police Agency and Korea’s Internet and Security Agency (KISA), both of which specialize in addressing threats originating from North Korea (DPRK).

Past incidents have linked DPRK hacking groups, such as Lazarus, to numerous cyberattacks targeting cryptocurrencies throughout 2023. It is believed that the stolen funds are being utilized to circumvent international sanctions and support the country’s weapons development program and cyber operations.

Additionally, experts in the blockchain field have highlighted that Orbit Bridge is an Ozys project, which also owns Belt Finance and KlaySwap.

These platforms have previously fallen victim to hacking incidents, believed to be orchestrated by highly skilled state-sponsored actors who utilized Border Gateway Protocol (BGP) hijacking techniques.

Ongoing Efforts to Contain Orbit Chain Cyber Attack

To address the aftermath of the recent hack on Orbit Chain, collaborative efforts with international partners are underway to track the stolen funds. A comprehensive endeavor is being conducted to freeze the illicitly obtained assets.

Furthermore, industry experts in the blockchain domain have brought attention to the fact that Orbit Bridge is a project under Ozys, the same entity that owns Belt Finance and KlaySwap. Unfortunately, these platforms have experienced prior hacking incidents, reportedly executed by sophisticated state-sponsored actors who employed Border Gateway Protocol (BGP) hijacking techniques.

Orbit Chain Hack: The Last Fintech Hack of 2023

Orbit Chain Cyber Attack is the last Fintech hack of 2023, but other cases portray an even grimmer picture.

According to Scam Sniffer, a blockchain threat tracking service, wallet drainers managed to steal a significant sum of $295 million from more than 320,000 victims in 2023. The notable cases include Inferno Drainer and MS Drainer.

Although Orbit Chain Lost $86 Million, the total losses for this year are near $2 billion.

In the annual report by security app De.Fi, it was revealed that cryptocurrency users suffered losses of nearly $2 billion due to scams, rug pulls, and hacks in 2023. Although this amount is lower than the previous year, it indicates that the industry is still vulnerable to security risks.